![]() Home

Home

![]() FAQ

FAQ

![]() Taxation

Taxation ![]() Hong Kong

Hong Kong ![]() Frequently Asked Questions for the Approved Charitable Donations in Hong Kong

Frequently Asked Questions for the Approved Charitable Donations in Hong Kong

Frequently Asked Questions for the Approved Charitable Donations in Hong Kong

| Q: |

What kind of donation is eligible for tax deduction? |

| A: |

The donation must be a donation of money and made to a charitable institution or a trust of a public character, which is exempted from tax under section 88 of the Inland Revenue Ordinance (https://www.ird.gov.hk/eng/pdf/s88list_emb.pdf) or to the Hong Kong Government for charitable purposes. Payments for purchase of lottery tickets or raffle tickets; admission tickets for charity shows; a grave space; goods in bazaar and services such as saying prayers, reservation of a space for ancestral worship were not eligible for tax deduction. |

|

Q: |

What is the limit of the allowable deduction? |

|

A: |

The aggregate of your donation can not be less than HK$100. Starting from 2008/09 onwards, the amount must not exceed 35% of your income after allowable expenses and depreciation allowances or assessable profits. |

|

Q: |

If the amount of my approved charitable donations exceeds the deduction limit, what can I do with the unused balance? |

|

A: |

If the amount of your approved charitable donations exceeds the deduction limit, your spouse can claim the unused balance in the relevant year of assessment. |

|

Q: |

How can I claim the deduction for approved charitable donations in Hong Kong? |

|

A: |

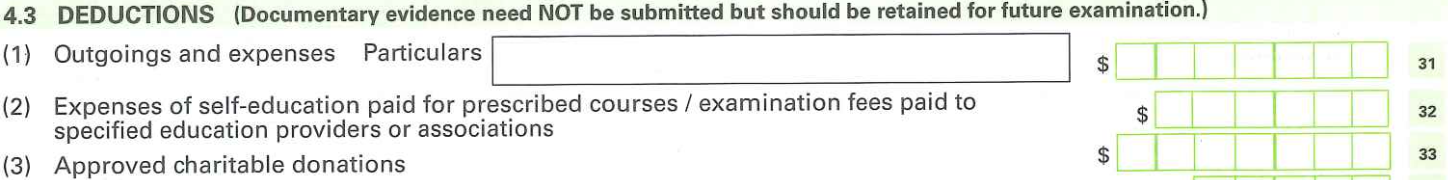

You can claim a deduction for approved charitable donations by completing Part 4.3 of your tax return (BIR60) for relevant year of assessment. |

|

Q: |

What documents do I need to submit as evidence for claiming the deduction for approved charitable donations? |

|

A: |

You do not need to attach the receipts issued by the tax-exempt charity or the Hong Kong Government as supporting documents when you submit the tax return in the relevant year of assessment. However, you should retain them for a period of not less than 6 years, because you may be selected by the Inland Revenue Department and required to produce the receipts for review. |