![]() Home

Home

![]() FAQ

FAQ

![]() Taxation

Taxation ![]() Hong Kong

Hong Kong ![]() Frequently Asked Questions for the Basic & Married Person’s Allowances in Hong Kong

Frequently Asked Questions for the Basic & Married Person’s Allowances in Hong Kong

Frequently Asked Questions for the Basic & Married Person’s Allowances in Hong Kong

| Q: |

What are the other allowances can I claim for Hong Kong salaries tax besides basic allowance? |

| A: |

In every year of assessment, if you fulfil the requirements, you are entitled to basic allowance and other allowances including:

|

|

Q: |

Can I claim both the basic allowance and the married person’s allowance at the same time in Hong Kong? |

|

A: |

No, you can only claim one at a time. You are entitled to the basic allowance unless you are married and have been granted the married person’s allowance for the year. |

|

Q: |

How can I be eligible for the married person’s allowance in Hong Kong? |

|

A: |

You can claim the married person’s allowance in any year of assessment if you are a) married at any time during that year, b) not living apart or living apart but are maintaining or supporting your spouse, and c) fulfil the following conditions:

|

|

Q: |

According to Hong Kong Inland Revenue Ordinance, is that a married person under same-sex will be entitled to claim allowances or deduction? |

|

A: |

In accordance with the section 2(1) of the Hong Kong Inland Revenue Ordinance, a same-sex marriage is now regarded as a valid marriage. A married person under same-sex will now also be entitled to claim allowances or deductions in respect of the person’s spouse, as well as elect for joint assessment or personal assessment with the person’s spouse. |

|

Q: |

How can I claim the married person’s allowance in Hong Kong? |

|

A: |

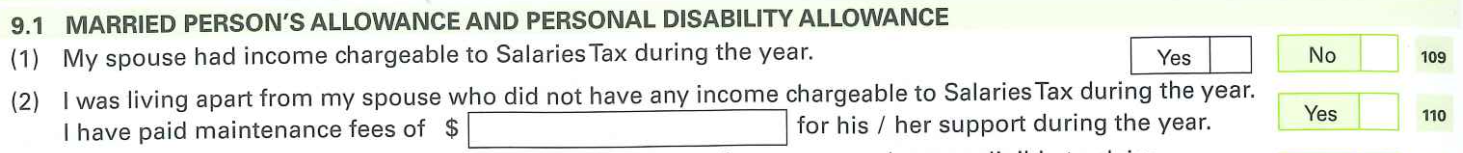

You can claim the married person’s allowance by completing Part 9.1 of your tax return (BIR60) for the relevant year of assessment. |