Q:

|

What is a Hong Kong Tax Deductible Voluntary Contributions (“TVC”)?

|

A:

|

Hong Kong TVC is a new type of contributions under the MPF system. Members with contribution accounts or personal accounts of MPF schemes, or members of MPF Exempted ORSO schemes are all eligible to make TVC. You may visit the MPF Schemes Authority’s website (http://www.mpfa.org.hk/eng/mpf_system/system_features/tvc/tvc_scheme_list.jsp) for list of MPF schemes which provide TVC.

|

Q:

|

Can I use my existing MPF accounts to make TVC?

|

A:

|

If you wish to benefit from such tax deductions, you must open a separate TVC account.

|

Q:

|

How to qualify for tax deduction?

|

A:

|

If you wish to benefit from tax deductions under salaries tax or personal assessment, the MPF voluntary contributions must be paid into a TVC account defined under the Mandatory Provident Fund Schemes Ordinance. You can only claim deduction for contributions made into a TVC account of which you are the account holder.

|

Q:

|

Can I get my money back earlier than my existing MPF schemes?

|

A:

|

To meet the purpose of encouraging extra savings for retirement, withdrawal of benefits from a TVC account has to fulfil the same requirements as for mandatory contributions. You can only withdraw benefits from the TVC account upon reaching the age of 65 or on the following statutory grounds:

1.

|

Early retirement at the age of 60 or above;

|

|

2.

|

Permanent departure from Hong Kong;

|

|

3.

|

Total incapacity;

|

|

4.

|

Terminal illness;

|

|

5.

|

A small balance of HK$5,000 or less; or

|

|

6.

|

Death

|

|

Q:

|

How to lodge a claim for tax deductible MPF voluntary contributions?

|

A:

|

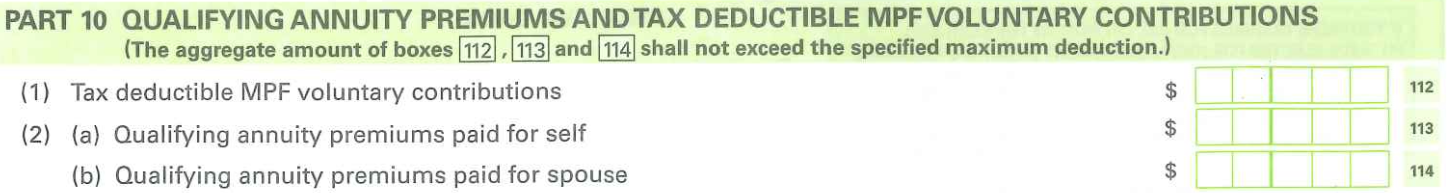

You may claim the tax deductible MPF voluntary contributions by completing Part 10 (1) of your Tax Return – Individuals (BIR60) for the relevant year of assessment.

|