Q:

|

What is a Hong Kong Qualifying Deferred Annuity Policy (“QDAP”)?

|

A:

|

Hong Kong QDAP is an insurance policy that is certified by the Insurance Authority to be in compliance with the specified criteria published by the Insurance Authority and regular payment is receivable by an annuitant during an annuity period. You may visit the Insurance Authority’s website (https://www.ia.org.hk/en/qualifying_deferred_annuity_policy/List_of_QDAP.html) for the list of certified plans eligible for tax deduction.

|

Q:

|

What are the requirements to be an “annuitant”?

|

A:

|

An annuitant must be a HKID card holder during the relevant year of assessment, and must be:

1.

|

yourself; or

|

|

2.

|

your spouse (at any time during the year of assessment); or

|

|

3.

|

yourself and your spouse (at any time during the year of assessment).

|

|

Q:

|

What is the amount of allowable deduction under Hong Kong Qualifying Annuity Premiums?

|

A:

|

From the year of assessment 2019/20 onwards, Hong Kong taxpayer can claim tax deduction for the premium paid for an eligible Hong Kong QDAP. The specified maximum deduction that a taxpayer can claim is up to HK$60,000 in each assessment year. The said maximum amount is an aggregate limit of the qualifying annuity premiums and tax deductible MPF voluntary contributions paid during a year of assessment. If a taxpayer claim both qualifying annuity premiums and tax deductible MPF voluntary contributions, tax deductible MPF voluntary contributions are to be firstly allowed while qualifying annuity premiums are to be secondly allowed.

|

Q:

|

How to qualify for tax deduction?

|

A:

|

Starting from 1 April 2019, Hong Kong taxpayer can claim a deduction for qualifying annuity premiums paid by him/ her and/ or his/ her spouse (not being a spouse living apart) as a policy holder of a Hong Kong QDAP policy for an annuity payment receivable by an annuitant. During the relevant year of assessment, the annuitant must also be a HKID card holder.

|

Q:

|

How to lodge a claim of the qualifying annuity premiums?

|

A:

|

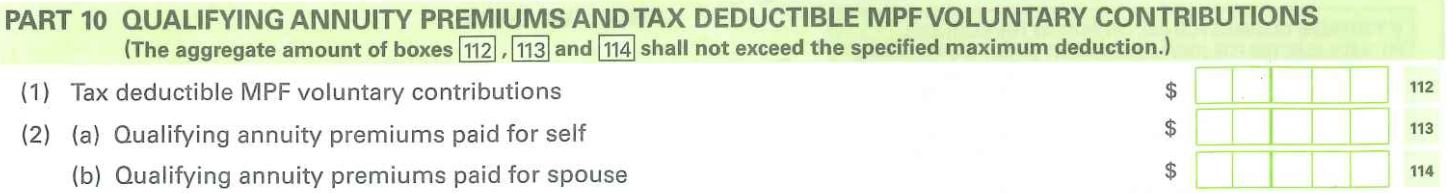

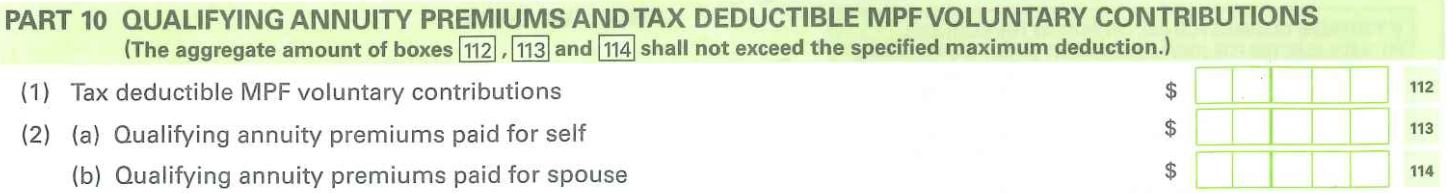

You may claim the deduction for qualifying annuity premiums paid by completing Part 10 (2) of your Tax Return – Individuals (BIR60) for the relevant year of assessment.

|