Job Support Scheme (JSS)

| Q: |

What is JSS? |

||||||||||||||||||||

| A: |

Under the JSS, the government will co-fund the first $4,600 of gross monthly wages paid to each local employee for 9 months. There are three levels of support for employers in different sectors, such as Aviation and Tourism, Food services and All other sectors. In addition, wage support for the month of Apr and May 2020 will be topped-up to 75% for all sectors to support firms during the ‘Circuit Breaker’ period. This will continue to be paid on the first $4,600 of gross monthly wages paid to local employees. Wage support for other months will remain unchanged. The aviation and tourism sectors will continue to receive 75% wage support for all applicable months. |

||||||||||||||||||||

|

Q: |

Who qualifies for the JSS? |

||||||||||||||||||||

|

A: |

All employers who have made CPF contributions for their local employee (Singapore Citizens and Permanent Residents) will qualify for payout. Employers in the employer exclusion list are not eligible for the JSS. Wages paid to business owners* or employer trading in their own personal capacity** will not eligible for the JSS payout. They will continue to receive the JSS payout for wages paid to their local employees. As announced on 21 April 2020, the government will extend the JSS to cover wages of employees in a company who are also shareholders and directors of the company (shareholder-directors)*. Wage support for shareholder-directors will only apply to companies registered on or before 20 April 2020, and only for the wages of shareholder-directors with Assessable income of $100,000 or less for Year of Assessment 2019. The May 2020 and subsequent JSS payouts will include support for qualifying shareholder-directors. The May 2020 payout will also include back payment for companies with qualifying shareholder-directors whose wages were excluded from the first JSS payout in April 2020. *Business owners are defined as follows:

** Employers trading in their own personal capacity include but are not limited to hawkers who do not have UEN, employers hiring local personal drivers or local domestic helpers, etc, The definition of director is set out in Section 4(1) of the Companies Act. For companies limited by guarantee, this applies to employees who are both members and directors of the company. |

||||||||||||||||||||

|

Q: |

Do we need to apply for JSS? |

||||||||||||||||||||

|

A: |

Employers do not need to apply for the JSS. IRAS will notify eligible employers by post of the tier of support and the amount of JSS payout payable to them. |

||||||||||||||||||||

|

Q: |

How is the JSS payout computed? |

||||||||||||||||||||

|

A: |

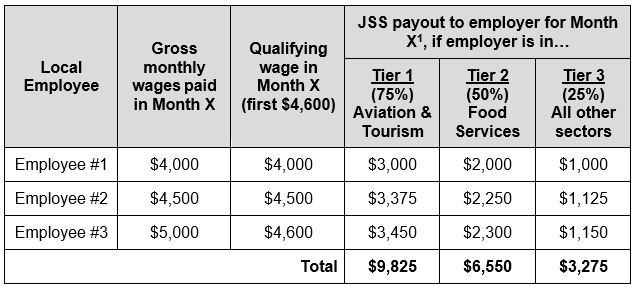

The table below shows a worked example of how the JSS payout is computed for an employer with 3 local employees earnings different wages. |

||||||||||||||||||||

|

Q: |

When will the company received payout? |

||||||||||||||||||||

|

A: |

Employers will received three main JSS payouts in Apr, Jul, and Oct 2020, covering wages paid in the months shown in the table below. There will also be an additional payout in May to provide cashflow support for firms during the circuit breaker’s period. The Apr 2020 and May 2020 payout will provide support in advance for Apr 2020 and May 2020 wages respectively. This is done in order to provide cashflow support for firms during the ‘Circuit Breaker’ period. These advances will be calculated based on Oct 2019 and Nov 2019 wages respectively. The subsequent JSS payout in Jul 2020 and Oct 2020 will be adjusted to account for these advances.

|