![]() Home

Home

![]() FAQ

FAQ

![]() Taxation

Taxation ![]() Hong Kong

Hong Kong ![]() Frequently Asked Questions for the election of Personal Assessment in Hong Kong

Frequently Asked Questions for the election of Personal Assessment in Hong Kong

Frequently Asked Questions for the election of Personal Assessment in Hong Kong

| Q: |

What is Hong Kong Personal Assessment? |

|

A: |

Personal assessment is not a levy of tax. It is a form of tax relief if your earned income not only chargeable to salaries tax but also those chargeable to profits tax and/or property tax. A taxpayer may choose to elect personal assessment to assess the total amount of the above-mentioned three taxable income (salaries tax, profits tax and property tax) as a whole. |

|

Q: |

Who is eligible for Personal Assessment in Hong Kong? |

|

A: |

For the year of assessment up to 2017/18: You may elect personal assessment if:

From the year of assessment 2018/19 onwards: You may elect for personal assessment if:

The main difference is if you are married and both of you have income assessable and eligible to make an election for personal assessment, the election for personal assessment must be jointly made with the spouse for the year of assessment up to 2017/18. Starting from the year of assessment 2018/19, you may elect for personal assessment separately from your spouse. |

|

Q: |

What is the meaning of “ordinarily resides in Hong Kong”? |

|

A: |

For the purpose of personal assessment, “ordinarily resides in Hong Kong” means that, apart from temporary or occasional absences from Hong Kong, such person habitually resides in Hong Kong, and is living in Hong Kong. Generally, Hong Kong Inland Revenue Department does not consider a person, who possesses Hong Kong Identity Card, automatically as “ordinarily resident in Hong Kong” if he/she lives outside Hong Kong continuously. Objective factors should be taken into consideration. |

|

Q: |

What is the meaning of “temporary resident” in Hong Kong? |

|

A: |

Temporary resident means you stay in Hong Kong for a period or a number of periods amounting to more than 180 days during the year of assessment for which the election is made or for a period or periods amounting to more than 300 days in 2 consecutive years of assessment, one of which is the year of assessment for which the election is made. |

|

Q: |

How can I elect for Personal Assessment in Hong Kong and is there a time limit to do so? |

|

A: |

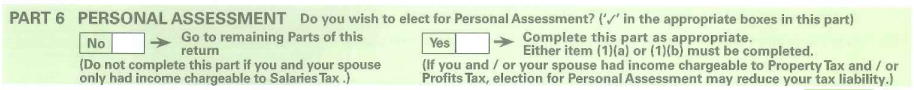

You can elect for personal assessment by completing Part 6 of your tax return (BIR60) for the relevant year of assessment.  If you failed to do so, you may still make an election within the prescribed time limit, i.e. within 2 years after the end of the year of assessment for which the election is made or within 2 months after the issue of a notice of assessment or a notice of additional assessment to tax for the year of assessment for which the election is made, whichever is the later. |